In the fast-paced world of local home service businesses, we’re often focused on providing the best possible service to our customers. But sometimes, the threats we face come not from dissatisfied clients or tricky projects, but from cybercriminals lurking in the shadows, waiting for an opportunity to strike.

Recently, one of my clients narrowly avoided falling victim to a particularly devious payroll scam. Here’s what happened and what you can do to protect your business from similar threats.

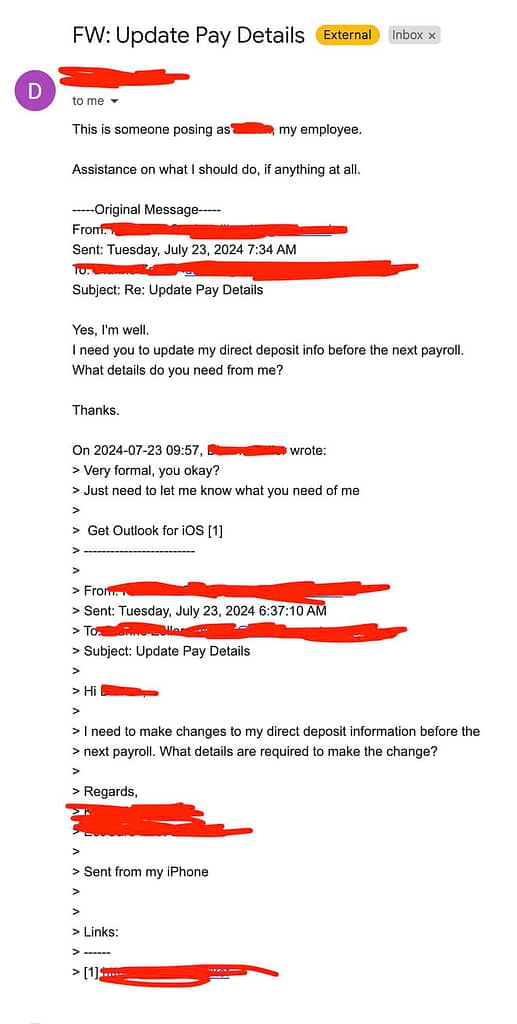

The Scam Uncovered

It all started with a seemingly innocuous email. The message, addressed to the admin team, appeared to come from one of the company’s employees. It was straightforward enough: a request to change the direct deposit information for payroll.

“Hi, I’ve recently changed my bank account and need to update my payroll details. Can you please change the information to the following account number?”

On the surface, it looked legitimate. The email used the employee’s name, and the tone matched what you’d expect from a professional communication. But there was one big problem: the employee in question hadn’t sent the email.

How My Client Caught the Scam

Fortunately, my client’s admin team was vigilant. They recognized that this type of request should never be handled over email without verification. Instead of making the change, they reached out to the employee directly, using the contact information they had on file. Sure enough, the employee had no idea what they were talking about.

By taking that extra step, my client avoided what could have been a disastrous mistake. If the payroll information had been updated as requested, the next paycheck would have gone straight into the scammer’s account, potentially costing thousands of dollars.

Protecting Your Business from Payroll Scams

Scams like these are becoming increasingly common, especially among small businesses where administrative processes might not be as rigorous as they should be. Here are some steps you can take to protect your business:

- Educate Your Team: Make sure your employees know about these types of scams and understand the importance of verifying requests for changes to payroll information or sensitive data.

- Implement Verification Procedures: Never change payroll information based on an email alone. Always verify the request with the employee directly, using a phone number or contact method that you have on file, not one provided in the email.

- Use Two-Factor Authentication: For any system that handles sensitive employee information, use two-factor authentication to add an extra layer of security.

- Regularly Review Your Security Protocols: Cyber threats are constantly evolving. Regularly review and update your security protocols to ensure they’re keeping up with the latest scams.

- Encourage Open Communication: Foster an environment where employees feel comfortable reporting suspicious emails or communications. The faster a potential scam is identified, the better.

Stay Vigilant

Cybersecurity can seem overwhelming, especially for smaller businesses that don’t have dedicated IT teams. But by taking a few simple steps to educate your team and implement basic verification procedures, you can significantly reduce the risk of falling victim to a payroll scam.

Remember, scammers are always looking for the easiest target. By staying vigilant and proactive, you can make sure that target isn’t your business.